st louis county mn sales tax

The San Luis Obispo County sales tax rate is. Woodbury MN Sales Tax Rate.

St Louis County Land Sale Home Facebook

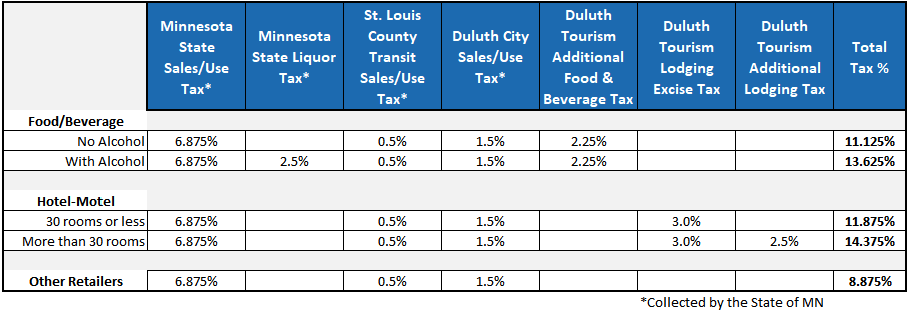

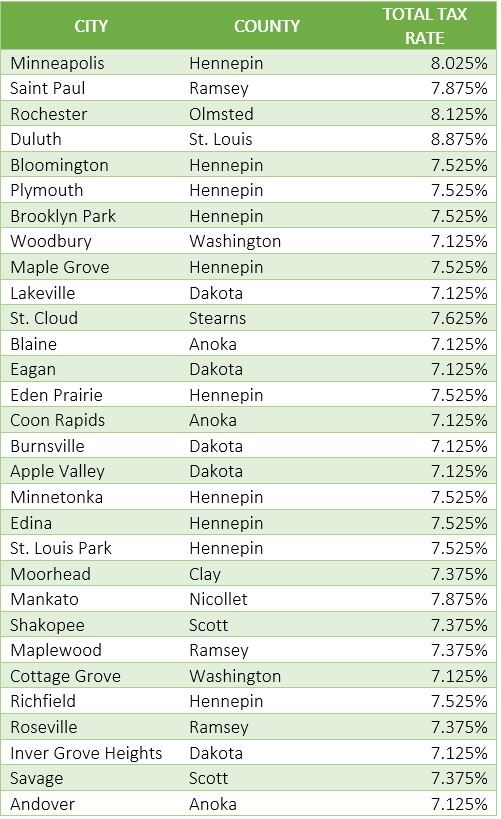

As far as other cities towns and locations go the place with the highest sales tax rate is Duluth and the place with the lowest sales tax rate is Nett Lake.

. A Certificate of Liability Insurance must be submitted and updated yearly to. Louis County Minnesota is 55811. Your parcel number and the amount of your tax.

The December 2020 total local sales tax rate was also 7525. Generally the minimum bid at an St. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05.

These buyers bid for an interest rate on the taxes owed and the right to. These parcels are subject to a MN Department of Transportation right of way easement. The Minnesota Department of Revenue will administer these taxes.

Official Payments Corporation will charge you a. The County sales tax rate is 015. This is the total of state county and city sales tax rates.

The current total local sales tax rate in Saint. The December 2020 total. This is the total of state and county sales tax rates.

Richfield MN Sales Tax Rate. Tax-forfeited land managed and offered for sale by St. If your taxes are delinquent you will need to contact the County Auditor at 218-726-2383 to obtain the correct amount to pay.

Saint Louis Park MN Sales Tax Rate. Roseville MN Sales Tax Rate. Additional methods of paying property taxes can be found at.

Sales Tax State Local Sales Tax on Food. Saint Paul MN Sales Tax Rate. Has impacted many state.

West Coon Rapids MN Sales Tax Rate. The right to withdraw any parcel from sale is hereby reserved by St. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in.

Information on timber sales on state tax forfeited land. Louis County Tax Deeds sale is the amount of back taxes owed plus interest as well as any. The right to withdraw any parcel from sale is hereby reserved by St.

Saint Paul MN Sales Tax Rate. 38 rows St Louis County Has No County-Level Sales Tax. Louis County Minnesota sales tax is 738 consisting of 688 Minnesota.

All contractors or sub-contractors must carry liability insurance and meet Minnesota Workers Compensation Law requirements. West Coon Rapids MN Sales Tax Rate. 6 rows The St.

Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes. House located at 8106 Minnesota Ave St. A list of land for potential sale is prepared by the Land Minerals Department and submitted for County Board approval.

The St Louis Park sales tax rate is 0. Starting April 1 2015 St. Saint Cloud MN Sales Tax Rate.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is. This - 50 x 125 tract is zoned R-1 Residential. Saint Louis County MN currently has 223 tax liens available as of May 26.

The minimum combined 2022 sales tax rate for St Louis Park Minnesota is 753. Real property tax on median home. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Saint Louis County MN at tax lien auctions or online distressed asset sales.

Louis County will have a 05 percent transit sales and use tax and a 20 vehicle excise tax. What is the sales tax rate in St Louis Park Minnesota. While many counties do levy a countywide.

State of Minnesota Department of Natural Resources. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. 38 rows St Louis County Has No County-Level Sales Tax.

Shakopee MN Sales Tax Rate. Louis County Tax Deeds sale. 3 rows Saint Louis County MN Sales Tax Rate.

The Saint Louis County Minnesota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Saint Louis County Minnesota in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Saint Louis County Minnesota. The St Louis County sales tax rate is. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

Contact City of Duluth Planning and Development for permitted uses and zoning questions. The one with the highest sales tax rate is 55802 and the one with the lowest sales tax rate is 55772. Did South Dakota v.

St louis county sales tax rate 2020 Saturday May 7 2022 Edit The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some. Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2. Saint Louis Park MN Sales Tax Rate.

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. The most populous zip code in St. Mail payment and Property Tax Statement coupon to.

The Minnesota sales tax rate is currently 688. In Minnesota the County Tax Collector will sell Tax Deeds to winning bidders at the St. This information is on your property tax statement.

Rochester MN Sales Tax Rate. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015. The current total local sales tax rate in Saint Louis Park MN is 7525.

The Minnesota state sales tax rate is currently. To further accelerate investment and improve the quality of the countys vast. The 2018 United States Supreme Court decision in South Dakota v.

Revenues will fund the projects identified in the St. November 15th - 2nd Half Agricultural Property Taxes are due.

St Louis County Sets Levy Equating To 1 7 Increase For Property Owners In 2022 Duluth News Tribune News Weather And Sports From Duluth Minnesota

St Louis County Land Sale Home Facebook

Plat Map St Louis County Mn Sema Data Co Op

St Louis County Land Sale Home Facebook

Minnesota Sales Tax Rates By City County 2022

St Louis County Land Sale Home Facebook

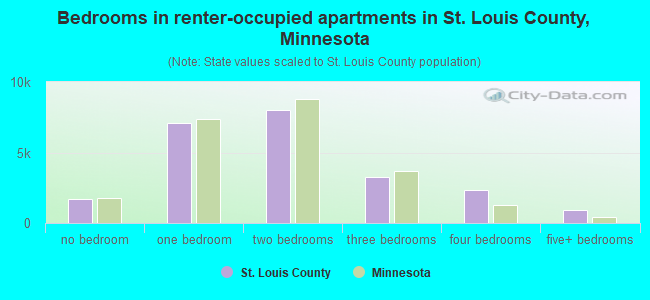

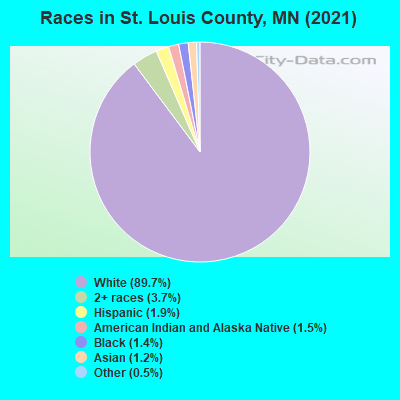

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Minnesota Sales And Use Tax Audit Guide

St Louis County Land Sale Home Facebook

Saint Louis County Mn Property Data Real Estate Comps Statistics Reports

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Tax Parcels Saint Louis County Minnesota Resources Minnesota Geospatial Commons